Facing the Threat of a Potential FPGA Shortage: a Call to Action

Consider this simple question. Can the defense and space industries count on a continued stable supply of mission-critical Field Programmable Gate Array (FPGA) components 10, 20, or even 30 years from now? Recent global events remind us that failing to adequately prepare for a catastrophe can lead to unintended consequences in domino-like succession. Some see the wisdom in seeking shelter before a tornado strikes, while others may argue that allowing events to play out is the preferred course of action. Planning for an eventual potential shortage of a critical military component may not be tops on everyone’s priority list. If an electronic guidance system for a warfighter is missing one critical part, that plane or missile will not fly. Let’s view the whole paradigm from a distance to see what’s missing, such as in the case of FPGA devices.

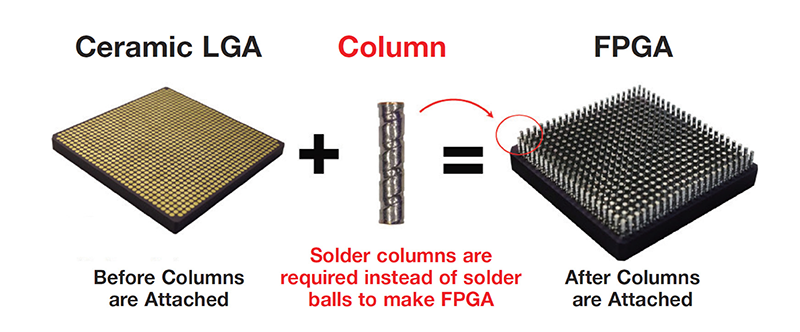

An FPGA is an integrated circuit (IC) configurable by customers in the field, and this particular capability makes them well suited to aerospace and defense applications. A fortified version, known as a Radiation Hardened (RadHard) FPGA, for example, can withstand attacks from electromagnetic and particle radiation in outer space. Defense and space grade FPGA devices often require solder columns, rather than solder balls, to attach the body of the IC package to a printed circuit board (PCB) assembly. These columns are a critical subcomponent in the final assembly of the FPGA.

An FPGA is an integrated circuit (IC) configurable by customers in the field, and this particular capability makes them well suited to aerospace and defense applications. A fortified version, known as a Radiation Hardened (RadHard) FPGA, for example, can withstand attacks from electromagnetic and particle radiation in outer space. Defense and space grade FPGA devices often require solder columns, rather than solder balls, to attach the body of the IC package to a printed circuit board (PCB) assembly. These columns are a critical subcomponent in the final assembly of the FPGA.

A sudden shortage of mission-critical FPGA devices could result in warfighters not flying and rockets not launching. This is not an exaggeration. Makers of ruggedized FPGA devices currently depend on a single subcontractor to attach these essential copper-wrapped solder columns to the body of the FPGA. Not anyone can perform solder column attachment, for reasons that we will explain.

Multiple Vendors vs. Sole Source for Column Attachment

Past production shortages in the semiconductor industry have been short-lived because multiple vendors have been able to quickly step in to fill voids in the supply chain. Today, only a single subcontractor is designated on the Qualified Manufacturer List (QML-38535) as a provider of copper-wrapped solder column attachment services for the entire FPGA industry. Any supply chain dependent on a single supplier is inherently vulnerable. Action is needed to resolve this vulnerability.

Any number of unfortunate causes, from natural disasters to internal business problems, could interrupt business continuation for this current monopoly supplier.

An existential threat could arise if a hostile foreign actor acquired or otherwise took control and, for example, relocated production offshore. A facility relocation typically results in the loss of QML status, pending requalification. It can take up to 24 months for a new candidate to undergo the arduous approval process before attaining QML status to provide the aforementioned services. A prolonged production shutdown of FPGA devices directly impacts US national security, affecting thousands of downstream customers who would be unable to complete systems and black box builds. Proactive steps taken now to identify and monitor the risks could mitigate such a threat.

The US Department of Defense (DoD) provides guidelines to help the industry identify and mitigate dependency on services from single-source subcontractors. The Defense Standardization Program Office publishes a helpful document, SD-22, titled, “Diminishing Manufacturing Sources and Material Shortages (DMSMS), a Guidebook of Best Practices for Implementing a Robust DMSMS Management Program.” It is a useful resource to aid FPGA device makers seeking to broaden their supplier base for components critical to national security.

The Under Secretary of Defense for Acquisition and Sustainment delivers an annual report to Congress titled “Industrial Capabilities” stating the mission of the Office of Industrial Policy (INDPOL), to ensure a robust, secure, resilient, and innovative industrial capabilities upon which the DoD can rely. Eight companies making the majority of the world’s FPGA devices may consider issuing forward-looking cautionary statements to stakeholders, citing their reliance on a single QML vendor to attach copper-wrapped columns. These statements disclose potential risks from the perspective of management’s reasoning or beliefs.

No Simple Matter

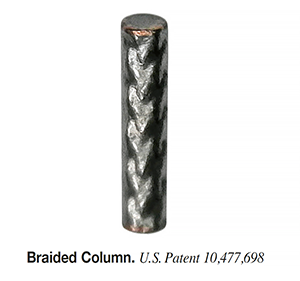

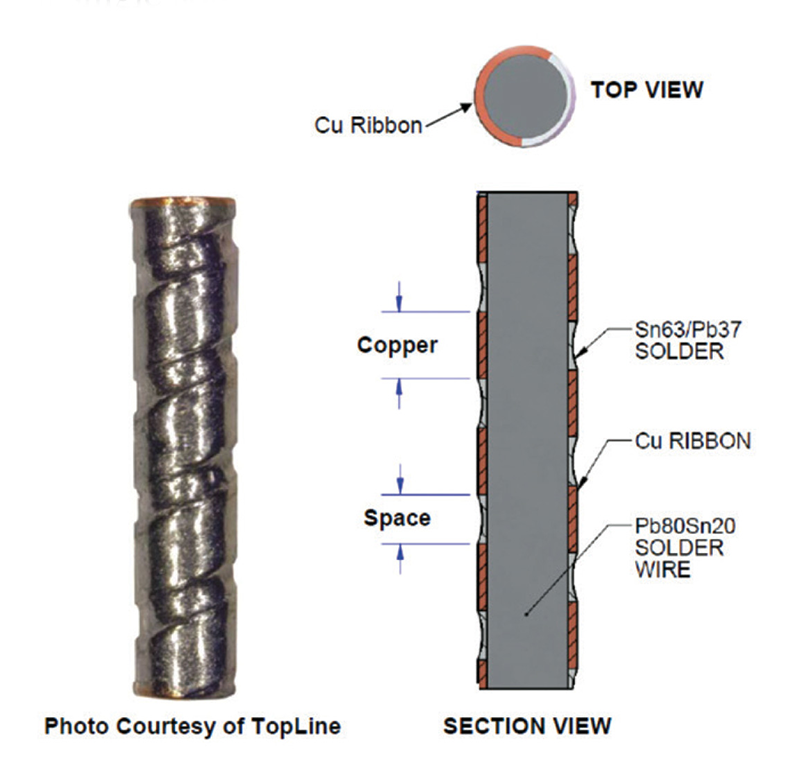

Fabrication of copper-wrapped solder columns is not simple and requires sophisticated knowledge, specialized manufacturing equipment, and proficient operator skills to properly attach the columns. They are neither readily nor commonly available.

The risk of an FPGA production shutdown is preventable by taking prudent action now. The most direct solution is to qualify multiple vendors for critical processes including column attachment. This remedy would require a relatively low investment by FPGA device makers.

Consequences of a Production Stoppage

A production stoppage of critical FPGA devices could result in the failure of the defense industry to fulfill commitments for the delivery of warfighters and other critical systems. Failure to deliver RadHard FPGA packages could potentially disrupt mission schedules.

A diminishing domestic manufacturing base and a fragile market are contributing risk factors for achieving robust and resilient production of FPGA devices. FPGA packages with solder columns are produced in a low-volume manufacturing environment; for example, approximately 75,000 individual FPGA devices spread over 100 different outline packages are produced annually.

Total annual volumes of FPGA and ASIC devices, with as much as 70 million copper-wrapped solder columns, are minuscule compared to volumes of commercial off-the-shelf (COTS) FPGA devices consuming billions of solder balls that dominate the COTS market. But attaching solder columns to FPGA packages is a substantially different process.

Solder Columns

Solder columns are cylindrically shaped pins that must be held vertically in place by precision fixtures without slanting or falling over during the attachment and solder reflow process. A final assembly step requires the entire matrix array of up to 1,752 columns to be planarized without damaging a single column. No manufacturing defects are allowed. Talented operator skills must be employed during every step in the process of attaching columns to FPGA packages. It is fundamentally a nonautomated, artisan process.

Fortunately, royalty-free, US-manufactured copper wrapped solder columns are readily available today in the supply chain. But starting from scratch, it could take 24 months for multiple subcontractors to undergo the arduous process of attaining QML status to provide column attachment services.

Companies that produce FPGA devices are not required to voluntarily qualify multiple subcontractors to perform solder column attachment services. A lack of funding by FPGA manufacturing is most often cited as the primary reason for not qualifying a second source. Multiple microelectronic subcontractors in the US supply chain are ready, willing, and able to provide these services, provided that funding is available to pay for the cost of QML qualification. An accelerated initiative by FPGA makers to mitigate risk and qualify multiple subcontractors requires a sizable investment. FPGA makers must take the lead in initiating the qualification of alternative subcontractors. As a practical matter, subcontractors cannot independently apply for QML status without the support of the FPGA maker.

The Department of Defense published an unclassified report titled, “Assessing and Strengthening the Manufacturing and Defense Industrial Base and Supply Chain Resiliency of the United States,” in fulfillment of Executive Order (EO) 13806, which describes risks that threaten America’s manufacturing and defense industrial base. The 10 “risk archetypes” described in the report are as follows: 1) sole source; 2) single source; 3) fragile supplier; 4) fragile market; 5) capacity constrained supply market; 6) foreign dependency; 7) diminishing manufacturing sources and material shortages (DMSMS); 8) gap in the US-based human capital; 9) erosion of US-based infrastructure; and 10) product security.

Most of the risks described in the report apply to FPGA manufacturing. Risk archetypes lead to a variety of impacts on America’s industrial base. These include reduced investment in new capital and R&D; reductions in the rates of modernization and technological innovation; potential bottlenecks across the many tiers of the supply chain; and lower quality and higher prices resulting from reduced competition.

Sole Source vs. Single Source – A Dangerous Distinction

A sole source risk exists when only one supplier can provide the required capability. A single source exists when only one supplier is qualified to provide the required capability. EO 13806 draws a key distinction between the sole source and single source. Multiple suppliers may exist, but only a single source for copper wrapped solder columns is currently qualified, according to the Qualified Manufacturing List (QML-38535) published by the Defense Logistics Agency (DLA).

Fortunately, manufacturing capability for producing copper wrapped solder columns exists today in the US. Also, multiple subcontractors capable of providing column attachment services for FPGA packages currently exist in America.

Companies that produce FPGA devices are not required to voluntarily qualify multiple subcontractors. As mentioned earlier, it could take 24 months for an alternative candidate starting from scratch to attain QML status should a single source supplier unexpectedly shut down.

Other risks

A fragile supplier is an individual firm that is financially challenged or distressed, and this potentially includes most subcontractors in the US microelectronics industry today. A fragile market occurs when domestic markets have structurally challenging economics and face the potential to move toward foreign dependency.

Presently, a capacity-constrained supply market may not be thought of as problematic. However, a single source supplier may not be able to keep up with a sudden surge in market demand. Foreign dependency on wafer foundries could become an elevated risk, especially when a domestic foundry does not produce a critical item.

The Human Element

Gaps in US-based human capital are an ongoing concern. The industry needs to keep fresh science, technology engineering, and math (STEM) talent in the pipeline, especially within the microelectronics assembly base. Erosion of US-based infrastructure, including the loss of specialized capital equipment, is a risk since attachment of solder columns to FPGA packages requires precision tools and fixtures that are difficult to fabricate. Last, product security could be of heightened concern under circumstances where FPGA packages require an assembly step overseas, opening the risk of reverse engineering or embedding trojans by foreign elements.

FPGA devices used in defense and aerospace applications must be produced by suppliers on the QML. Six-Sigma, based in Milpitas, CA, is already QML- 38535-approved for attaching copper wrapped columns. Multiple contractors are at various stages of tooling up, awaiting DLA certification. VPT Components and Micross Components have also demonstrated the capability to perform these services, and other suppliers plan to offer them. By the end of 2021, five contractors will probably be qualified to attach columns.

Recently, the COVID-19 pandemic has introduced risks not previously considered that could threaten America’s dominance in warfighter technology. An early casualty of Covid-19 was an advisory to halt travel to conduct QML-38535 audits by DLA employees. DLA audits that were scheduled in March 2020 were abruptly canceled. This unexpected event blocks new suppliers from participating in the QML market. The stoppage of DLA field audits means an indeterminate delay in qualifying additional suppliers to make QML FPGA devices. DLA cites no date when field audits will resume. Would DLA consider conducting virtual QML audits using video platforms to support the supply chain?

As mentioned earlier, copper-wrapped column attachment services are currently dominated by a single-source monopoly. The introduction of fresh competition to perform these services might be expected to promote competitive pricing and speed deliveries. Multiple vendors increase the likelihood that a strong, resilient industrial base and supply chain will result. Original device makers (ODM) have noted that FPGA and ASIC packages have been suspended in financial limbo for more than a year, while products remain in a state of work-in-process (WiP) before generating cash flow.

Many manufacturing steps are required to produce ceramic FPGA devices. In the first stage, it takes a minimum of six months to procure and produce land grid array (LGA) packages, consisting of ceramic housings, along with necessary die bonding and lid sealing. Then, it takes a reported additional six months for the current monopoly supplier to attach solder columns to convert the LGA package into a column grid array (CGA or CCGA). Finally, it takes months to perform final testing before the customer receives the delivery. This lengthy production cycle can be significantly reduced by having multiple capable vendors because they collectively can perform column attachment services in weeks rather than many months.

New Markets Emerging

Emerging markets for Artificial Intelligence (AI) and 5G utilize super-sized organic packages, components too large for reliable BGA packaging. Alternative interconnects are needed to ensure reliability. This is a burgeoning market sector wherein a new type of solder column utilizing copper braid or copper cores, rather than copper wrapping, has the potential to dissipate more heat while offering compliance to extremely large AI and 5G base station packages.

It’s time for advocacy stakeholders to initiate a shared vision to ensure a robust, resilient, and sustainable supply chain for FPGA devices. Domestic manufacturing of copper wrapped solder columns is already available. The next step is to qualify multiple microelectronic subcontractors ready and willing to provide this process. A prudent investment today can mitigate the risk of waiting for an unexpected disaster to strike, potentially costing the defense industry hundreds of millions of dollars. A production stoppage of critical FPGA components could ultimately diminish market readiness. By the end of 2021, it is anticipated that several subcontractors will offer column attachment services to the industry, once DLA can resume auditing and certifying new QML suppliers of these services. Greater US government support to help fund programs to strengthen this critical area will result in enhanced readiness, greater security of supply, and fewer program delays.

Conclusion

The speed with which the current brittle market can be fortified depends on judicious access to funding, which will drive the next steps in the roadmap. Step one is the US Department of Defense funding an industry effort to strengthen the supply chain. Step two requires the engagement of subject matter experts (SME) with intimate knowledge of components used in the defense industry to vet proposals from the supply chain. If neither step is initiated, then step three should be initiated, i.e., the eight dominating ODM producers of FPGA components should allocate reasonable funding to aggressively encourage multiple subcontractors to qualify solder column attachment services in preparation for certification by DLA. If none of those steps occurs, then we have step four, in which independent subcontractors in the supply chain deploy their sources of funding to develop processes to attach solder columns to prepare for DLA certification. Step five follows, a proactive discussion with stakeholders, including the DoD, SMEs, FPGA makers, and downstream customers to gain momentum for developing a resilient, robust supply chain for column attachment services. This course of action is much more desirable than waiting for calamity to strike. The imperative is a Call to Action to provide the defense and space industries with an uninterrupted supply of mission-critical Field Programmable Gate Array (FPGA) components 10, 20, and even 30 years from now.

REFERENCES

- Topline Corporation., New Copper Braided Solder Columns for FPGA and Large Ceramic Modules, Jan. 1, 2020; www.topline.tv/pdf files/Braided_ Column_Introduction.pdf.

MARTIN HART is the chief executive officer of TopLine Corp. (topline.tv) and holds several US patents related to CCGA assembly and vibration damping; hart@ topline.tv.